LÂMINA DE FUNDO

Bram Private FI Multimercado Dinamico - 04.875.059/0001-84

fundo cancelado

Bram Private FI Multimercado Dinamico - 04.875.059/0001-84

04.875.059/0001-84

Multimercado

Preço da Cota

R$ 8,2175068

Atualizado: 13/11/2017

Rentabilidade (Últ. 12 Meses)

0.00%Patrimônio Líquido

R$ 35.678.849,16

Atualizado: 13/11/2017

Classe ANBIMA

Multimercados

Subclasse

Estratégias

Tipo ANBIMA

Livre

Data Inicial

02/05/2002

Benchmark

OUTROS

Administrador

Bem - Distribuidora de Titulos e Valores Mobiliarios Ltda.

Gestor

Bram - Bradesco Asset Management S.A. Distribuidora de Titulos e Valores Mobiliarios

Rentabilidade

Período

12 M

24 M

36 M

MÁX

Retorno Mensal

Retorno Mensal (%)

| JAN | FEV | MAR | ABR | MAI | JUN | JUL | AGO | SET | OUT | NOV | DEZ | ANO | %CDI | ACUM. FUNDO | ACUM. %CDI | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2017 | 2.18 | 2.18 | 2.20 | 0.50 | 1.10 | 1.05 | 1.23 | 1.32 | 1.90 | -0.41 | 0.43 | - | 14.52 | - | 219.80 | 558.38 |

| 2016 | 0.68 | 0.77 | 0.58 | 1.87 | 0.25 | 1.18 | 1.58 | 1.10 | 1.37 | 1.29 | 0.13 | 1.97 | 13.52 | - | 179.25 | 455.37 |

| 2015 | 0.99 | 0.70 | 1.28 | 0.88 | 1.36 | 1.03 | 1.53 | 0.78 | 0.70 | 0.81 | 1.20 | 1.28 | 13.28 | - | 145.99 | 370.87 |

| 2014 | 0.96 | 0.55 | 0.67 | 0.73 | 0.87 | 0.79 | 1.08 | 1.16 | 0.31 | 0.41 | 0.96 | 0.46 | 9.32 | - | 117.16 | 297.63 |

| 2013 | 1.04 | 0.29 | 0.64 | 0.74 | 0.71 | 0.55 | 0.74 | 0.64 | 0.11 | 0.85 | 0.84 | 0.74 | 8.18 | - | 98.64 | 250.59 |

| 2012 | 1.18 | 0.87 | 0.81 | 0.85 | 0.83 | 0.72 | 0.87 | 0.38 | 0.81 | 0.57 | 0.61 | 0.92 | 9.84 | - | 83.62 | 212.43 |

| 2011 | 0.64 | 0.87 | 1.14 | 0.87 | 0.90 | 0.89 | 0.87 | 1.20 | 1.02 | 1.11 | 0.77 | 0.60 | 11.44 | - | 67.17 | 170.64 |

| 2010 | 0.80 | 0.73 | 0.96 | 0.63 | 0.80 | 0.85 | 0.86 | 0.97 | 0.91 | 0.81 | 0.76 | 1.02 | 10.58 | - | 50.01 | 127.05 |

| 2009 | 1.55 | 1.20 | 1.32 | 0.91 | 1.21 | 1.37 | 1.06 | 0.82 | 0.80 | 0.81 | 0.87 | 0.87 | 13.56 | 78.52 | 35.66 | 90.59 |

| 2008 | 0.87 | 1.03 | 0.09 | 0.56 | 0.96 | 0.20 | 0.41 | 0.73 | 1.46 | 0.33 | 1.98 | 2.10 | 11.24 | 57.76 | 28.10 | 144.40 |

| 2007 | 1.22 | 0.84 | 1.11 | 1.39 | 1.09 | 0.92 | 0.65 | 0.44 | 0.94 | 0.88 | 1.01 | 0.81 | 11.90 | 78.50 | 41.50 | 273.75 |

| 2006 | 1.62 | 1.80 | 1.23 | 1.00 | 0.57 | 1.54 | 1.27 | 1.62 | 0.50 | 1.74 | 1.73 | 1.43 | 17.27 | 39.36 | ||

| 2005 | 1.22 | 1.17 | 1.66 | 1.03 | 1.74 | 1.69 | 1.45 | 1.78 | 1.58 | 1.47 | 1.59 | 1.54 | 19.46 | 103.29 | 19.46 | 103.29 |

| 2004 | 1.25 | 1.12 | 1.60 | 1.04 | 0.29 | 1.98 | 1.61 | 1.18 | 1.19 | 0.98 | 0.58 | 1.39 | 15.16 | 15.16 | ||

| 2003 | 2.56 | 2.15 | 1.90 | 1.79 | 2.61 | 1.94 | 2.34 | 2.01 | 1.88 | 1.49 | 1.69 | 1.35 | 26.45 | 26.45 | ||

| 2002 | 3.01 | 1.43 | 4.37 | 1.46 | 2.75 | 2.50 | 1.99 | 18.84 | 18.84 |

Composição

Última atualização: 21/02/2026

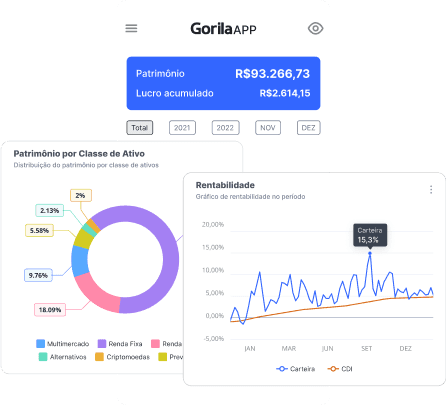

Patrimônio

R$ 35.678.849,16

Cotistas

1

Essa página foi criada a partir de dados públicos fornecidos por órgãos como CVM (Comissão de Valores Mobiliários) e ANBIMA (Associação Brasileira das Entidades dos Mercados Financeiro e de Capitais) e não representa análise ou recomendação. Sendo assim, nós do Gorila não nos responsabilizamos pela veracidade e/ou atualização dos dados aqui apresentados, pois estes são de responsabilidade dos gestores dos fundos.