LÂMINA DE FUNDO

BB CARTON MULTIMERCADO FUNDO DE INVESTIMENTO EM COTAS DE FUNDOS DE INVESTIMENTO CRÉDITO PRIVADO

BB CARTON MULTIMERCADO FUNDO DE INVESTIMENTO EM COTAS DE FUNDOS DE INVESTIMENTO CRÉDITO PRIVADO

05.755.513/0001-26

Preço da Cota

R$ 4,120992545

Atualizado: 02/12/2016

Rentabilidade (Últ. 12 Meses)

0.00%Patrimônio Líquido

R$ 0,00

Atualizado: 20/02/2026

Classe ANBIMA

Subclasse

Tipo ANBIMA

Não se aplica

Data Inicial

16/02/2004

Benchmark

Administrador

Gestor

Rentabilidade

Período

12 M

24 M

36 M

MÁX

Retorno Mensal

Retorno Mensal (%)

| JAN | FEV | MAR | ABR | MAI | JUN | JUL | AGO | SET | OUT | NOV | DEZ | ANO | %CDI | ACUM. FUNDO | ACUM. %CDI | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2016 | 0.92 | 0.81 | 1.02 | 0.95 | 1.08 | 0.82 | 1.12 | 1.21 | 1.08 | 0.99 | 0.85 | 0.01 | 11.41 | - | 154.91 | 1010.50 |

| 2015 | 0.93 | 0.84 | 1.06 | 0.98 | 1.06 | 1.11 | 1.21 | 1.14 | 1.14 | 1.09 | 0.95 | 1.14 | 13.41 | - | 128.80 | 840.18 |

| 2014 | 0.18 | 0.71 | 0.73 | 0.84 | 0.88 | 0.83 | 0.96 | 0.87 | 0.92 | 0.98 | 0.82 | 1.07 | 10.24 | - | 101.75 | 663.73 |

| 2013 | 0.49 | 0.18 | 0.07 | 0.66 | 0.07 | 0.05 | 0.70 | 0.48 | 0.62 | 0.80 | 0.64 | 0.65 | 5.54 | - | 83.01 | 541.49 |

| 2012 | 0.90 | 0.76 | 0.50 | 0.76 | 0.29 | 0.52 | 0.79 | 0.75 | 0.60 | 0.95 | 0.62 | 0.84 | 8.60 | - | 73.40 | 478.80 |

| 2011 | 0.85 | 0.83 | 0.90 | 0.80 | 0.96 | 0.95 | 0.93 | 1.13 | 0.98 | 0.87 | 0.90 | 0.88 | 11.55 | - | 59.67 | 389.24 |

| 2010 | 0.62 | 0.51 | 0.58 | 0.62 | 0.60 | 0.74 | 0.79 | 0.91 | 0.83 | 0.75 | 0.82 | 0.92 | 9.04 | - | 43.14 | 281.41 |

| 2009 | 0.98 | 0.88 | 1.00 | 0.80 | 0.73 | 0.85 | 0.89 | 0.55 | 0.90 | 0.83 | 0.72 | 0.73 | 10.32 | 67.32 | 31.27 | 203.98 |

| 2008 | 0.93 | 0.80 | 0.81 | 0.88 | 0.83 | 0.95 | 0.88 | 0.83 | 0.54 | 0.70 | 1.08 | 1.20 | 10.94 | 57.61 | 25.00 | 131.65 |

| 2007 | 1.04 | 0.84 | 1.01 | 1.07 | 1.05 | 0.91 | 0.89 | 0.87 | 0.84 | 0.88 | 0.91 | 0.83 | 11.73 | 92.58 | 11.73 | 92.58 |

| 2006 | 1.55 | 1.19 | 1.39 | 1.07 | 1.20 | 1.21 | 1.27 | 1.26 | 1.07 | 1.12 | 1.03 | 0.99 | 15.33 | 15.33 | ||

| 2005 | 1.35 | 1.24 | 1.52 | 1.40 | 1.49 | 1.59 | 1.47 | 1.65 | 1.49 | 1.41 | 1.43 | 1.47 | 18.99 | 18.99 | ||

| 2004 | 1.33 | 0.74 | 0.99 | 1.26 | 1.31 | 1.36 | 1.07 | 1.14 | 1.30 | 1.50 | 12.67 | 12.67 |

Composição

Última atualização: 20/02/2026

Patrimônio

R$ 0,00

Cotistas

0

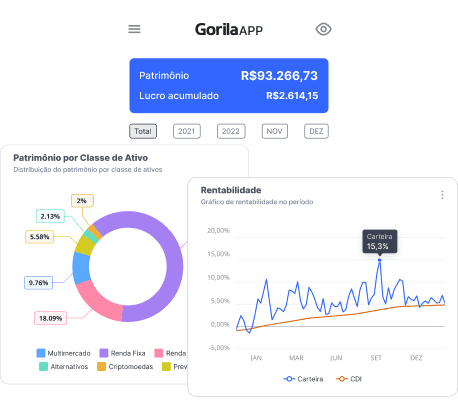

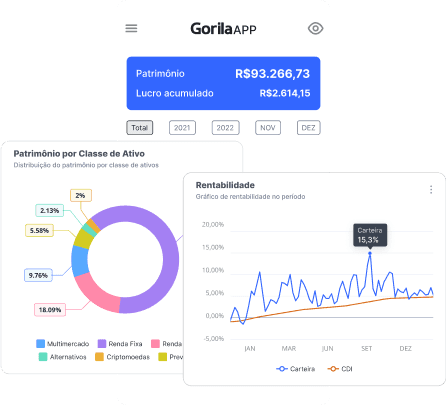

Essa página foi criada a partir de dados públicos fornecidos por órgãos como CVM (Comissão de Valores Mobiliários) e ANBIMA (Associação Brasileira das Entidades dos Mercados Financeiro e de Capitais) e não representa análise ou recomendação. Sendo assim, nós do Gorila não nos responsabilizamos pela veracidade e/ou atualização dos dados aqui apresentados, pois estes são de responsabilidade dos gestores dos fundos.