July 2023 Updates

We've introduced changes designed to make your work smoother and easier, while ensuring that our API remains as intuitive and robust as ever.

Refined Requirements for Banking Bond in Create Transactions

To enhance semantic cohesion in all our transaction creations, we've updated the required parameters for Banking Bonds (CDB, LC, LCI, LCA, LF). Now, both price and quantity are required, replacing the previous requirement of quantity only.

Introducing the price-conversions Endpoint

Understanding the needs of your evolving business landscape, we've developed a brand-new endpoint. The Price Conversion endpoint converts transaction details into price and quantity, effectively accommodating the aforementioned change and serving other potential use cases.

For example, if you have a fund's total invested amount and aim to convert it into price and quantity, use the endpoint as follows:

Request: POST /securities/price-conversions

Body:

{

"security": {

"cnpj": "26673556000132"

},

"date": "2023-06-23",

"notional": 10000

}

Response:

{

"security": {

"id": 2363053,

"cnpj": "26673556000132",

"name": "ALASKA INSTITUCIONAL FIA",

"type": "FUNDQUOTE",

"assetClass": "STOCKS"

},

"date": "2023-06-23",

"price": 3.2519722,

"quantity": 3075.0570377

}

This instantly converts the notional of R$ 10.000,00 of a chosen Fund into price and quantity, ready for use in the Create Transaction endpoint.

✅ The supported securities for this endpoint span Banking Bonds (CDB, LC, LCI, LCA, LF), all fundquote types, and Corporate Bonds (CRI, CRA, Debentures).

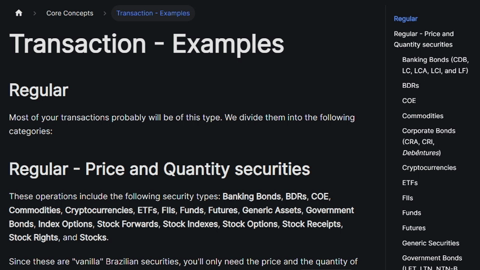

Revamped Transactions Documentation and Added Transaction Examples

We're thrilled to unveil our completely revamped Transactions page. Our goal? To simplify your understanding and creation of transactions on Gorila CORE. This page now provides detailed insights on different transaction types (REGULAR, COME_COTAS, OPTION_EXERCISE, CUSTODY_TRANSFER, and SUBSCRIPTION_RECEIPT_EXERCISE), elaborating on their functions and usage.

To further empower your transaction creation process, we've linked this to our brand-new Transactions Examples page, showcasing how to create transactions for all securities supported by Gorila.

Enhanced Documentation for IRR, TWR, PNL, NAV, Average Price and Position

Dive deeper into your financial metrics! We've enriched our documentation for Internal Rate of Return (IRR) and Time Weighted Return (TWR), complete with examples to discern their differences and understand when to utilize each.

Our documentation for Net Asset Value (NAV), Profit & Losses (PNL), and Average Price have also been amplified to give you a comprehensive understanding of each metric's significance and application.

Expanded Securities Documentation

We've infused our Securities documentation page with a wealth of new insights. As a key element for a successful Gorila CORE implementation, understanding securities is pivotal.

Now, discover examples on creating securities, such as Banking Bonds, and learn how to conduct transactions using these newly minted securities.

Integrated Backlinks from API Reference to Core Concepts

To enable a quick and convenient understanding of the concepts used in our endpoint reference, we've incorporated backlinks to Core Concepts. Navigation has never been smoother!

Enhanced Security Search Experience

In our constant endeavor to simplify and enrich your interaction with our API, we've refined the security search process. With the introduction of a relevance-based ranking system, your most pertinent securities now ascend to the top of your search list. Say goodbye to sifting through an ocean of securities—your most relevant results are now just a search away!